商机链接

汇聚全球1.1万+付费会员,66万+注册用户,覆盖179个国家,全年220万+次商机撮合量

合作保障

严格准入门槛,建立有信誉的圈子,平台提供最高15万美元合作风险保障

营销推广

官方邮件和社媒推广,推广您的商铺和品牌,每年举办多场全球大型会议

经营提效

免手续费的支付服务,享受全球会议折扣、保险、及物流工具优惠价

搜索全球优质代理

丰富的全球会员资源覆盖179个国家1.1万+付费会员,66万+注册用户

多种业务类型会员

从危险品到大型项目,丰富的会员和精准的搜索筛选助你快速找到专业合作伙伴

保障合作无忧

严格的入会审查机制,打造诚信合作圈子,提供最高15万美金的财务保障

数字化商铺

丰富的标签、证书、视频展示业务能力,在线IM接待实时与客户沟通

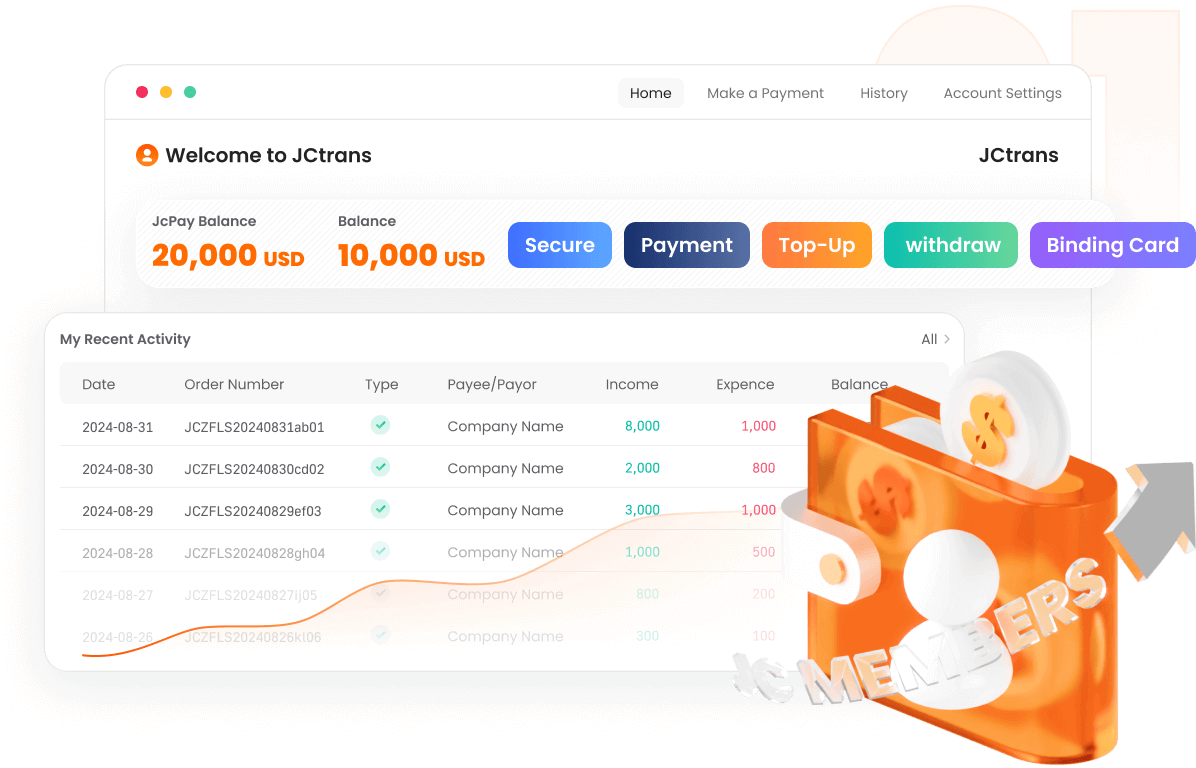

会员一站式免费使用

JCtrans会员账号已免费升级权益,可直接登录进行交易

0手续费,实时到账

会员间收付款没有任何手续费且实时到账

安全可靠

稳定的银行合作关系,保证账户资金安全